Weekly Market Commentary

Weekly Market Commentary

-Darren Leavitt, CFA Market action was mixed in a holiday-shortened week of trade. The Santa Clause rally, which runs for the last five trading sessions of the year through the first two trading sessions of the New Year, kicked off with gains from mega-cap...

Weekly Market Commentary

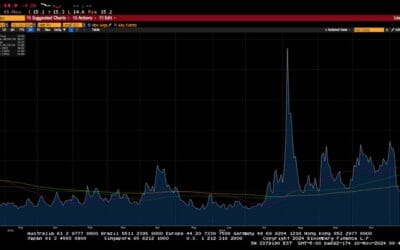

-Darren Leavitt, CFA Equity and fixed-income markets sold off for the second consecutive week as the Federal Reserve delivered an expected twenty-five basis-point rate cut but pivoted to a much more hawkish stance for 2025, where the committee now expects only two...

Weekly Market Commentary

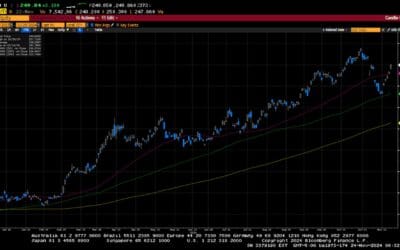

-Darren Leavitt, CFA The Nasdaq eclipsed the 20,000 level for the first time this week as investors reengaged in buying the mega-cap technology names. Amazon, Google, Tesla, and Meta hit new highs for the year as investors heard about more advances in AI and quantum...

Weekly Market Commentary

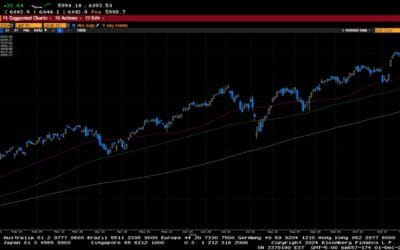

The S&P 500 forged another set of all-time highs as investors embraced the idea of an economy running at a pace appropriate for the Fed to consider further rate cuts. Leadership in the market toggled back to the mega-cap technology issues, with the communication...

Weekly Market Commentary

The S&P 500 forged another set of all-time highs as investors embraced the idea of an economy running at a pace appropriate for the Fed to consider further rate cuts. Leadership in the market toggled back to the mega-cap technology issues, with the communication...

Weekly Market Commentary

-Darren Leavitt, CFA The holiday-shortened week saw the S&P 500 and Dow rise to new all-time highs. Investors cheered the nomination of Scott Bessent as Treasury Secretary, who is seen as a fiscal hawk and someone who will support Trump’s trade policies. US...

Weekly Market Commentary

-Darren Leavitt, CFA Markets bounced back as investors reengaged the pro-growth Trump 2.0 trade. President-elect Trump continued to fill out his cabinet and, late Friday announced Scott Bessent as his nominee for Treasury Secretary. Wall Street has endorsed Bessent,...

Weekly Market Commentary

-Darren Leavitt, CFA US equity markets pulled back last week as investors took profits from the outsized move higher seen following the US election. Sticky inflation prints, coupled with solid retail sales and hawkish comments from Federal Reserve Chairman J. Powell,...

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 notched its 50th all-time high of 2024 as investors piled into equities after a decisive US election. Wall Street embraced the idea that President-Elect Trump would enact several pro-growth policies to bolster corporate profits. ...

Phone (253) 638-7121

Sprylen Wealth Management, LLC is a registered investment adviser in the state of Washington. The Adviser may not transact business in states where it is not appropriately registered or exempt from registration. Individualized responses to persons that involve either the effecting of transactions in securities or the rendering of personalized investment advice for compensation will not be made without registration or exemption. Most states exempt us for up to 6 clients.